Selected Topic

Issue 1 - After Crisis – Contemporary Architectural Conditions (Feb 2011)

Show articles

Ensanche de Vallecas, 2001

Case study I: coast filling

Case study II: golf resorts

Case study III: paper parks

Case study IV: new towns

Case study V: new towns

Case study VI: urban hyperexpansion

4.7.2012 – Issue 1 - After Crisis – Concheiro Isabel – Essays

SPAIN INTERRUPTED - On the Form of the Financial Bubble

by Isabel Concheiro

1. The Spanish Financial Bubble in the Context of the Liberal Market

In Spain, 2006 was a milestone as regards the number of houses constructed: 760,000; more than the 650,000 started that year in France and the United Kingdom, whose combined populations almost triple that of Spain. Between 2001 and 2008 around four million new houses have been built and the average number of housing units completed per year was 565,000, more than double the figure of 250,000 for the previous decade. This is equivalent to the construction of twelve dwellings per thousand inhabitants, far in excess of the European average of five per thousand.

In 2009, after the collapse of the construction sector caused by the bursting of the housing bubble and the effects of the global economic crisis, the number of housing units started fell to 160,000, and there were almost 700,000 housing units in stock (that is, completed but unsold).

The construction of this enormous quantity of housing, as well as infrastructure and commercial areas for the interconnection and supply of new residential developments has dramatically increased rates of soil artificiality. In recent years, land consumption has increased by 29.5 percent, as opposed to the EU average of 5.4 percent, with much higher values being reached in some regions (50 percent and 60 percent in Valencia and Murcia, respectively, and more than 40 percent in Madrid).

After the seven years of the housing boom, in which construction has largely been linked to investment and speculation, a stroll through the country shows a mosaic of scattered, unrelated developments, the existence of empty housing stock, interrupted building sites, and large tracts of reclassified land awaiting future development.

This, of course, is not the only consequence of the enormous development of the construction sector seen in recent years, which at the same time has produced high-quality architecture, both public and private. But the goal is to analyze the consequences, in the Spanish context, of having left the housing market mainly in private hands and under the lack of limitations on the free market.

How has this growth come about? And above all, what landscape has it left us?

If we are to understand how the housing bubble was generated a mere description in quantitative terms is not sufficient; we need to consider what type of housing has been built and where it is located. A first assessment of data for this period could lead one to think that this bubble could also have been somehow necessary: in terms of housing, Spain suffered from a shortage of primary residences in relation to other more advanced European countries (in 2004, the number of principal dwellings per 1,000 inhabitants was 350, compared with the European average of 400). Moreover, in recent years the population has grown by six million inhabitants. Therefore, these four million new homes could have been used to alleviate the deficit, both inherited and generated.

Further analysis reveals, however, that much of the new housing was not intended for primary residences, but for secondary and vacant residence (available for sale or rent, or simply abandoned, due their poor condition or investment character). Secondary residences have maintained a rate of growth similar to previous decades, as tourism is still one of the key economic sectors. In contrast, the number of vacant homes has increased due to housing’s being considered as a long-term investment or as a kind of speculation for short-term benefits. Spain is the European country with the largest number of total housing units per 1,000 inhabitants, and the country with the most second and vacant homes. Paradoxically, at the end of this period there is still a primary housing shortage, as this represents only 66 percent out of the total of 25 million households.

Although the housing bubble is evident throughout the country, it has been stronger on the Mediterranean coast and in the metropolitan area of Madrid. These regions show the greatest increase in second homes (25 percent in Murcia and 19 percent in Valencia vs. 13 percent for Spain and the largest amount of housing stock (61 percent on the Mediterranean coast and 14 percent in Madrid and neighboring provinces). In these areas, there are also large tracts of reclassified land. (A study of urban plans in 52 Valencia municipalities shows that 700,000 new housing units for two million residents could be built on the land already approved.)

If the increase in housing had been mainly related to the construction of primary housing , we would not be talking about a housing bubble, but rather the evolution of a sector to overcome a deficit. Instead, we are dealing with a real estate bubble, as much of this growth is the result of urbanization for speculative purposes, irreversibly transforming the landscape and creating housing stock that is difficult to reuse.

What form do these speculative landscapes take?

The importance of the construction sector in the Spanish economy on one hand, and the confidence in a liberal management of the housing market on the other, have largely determined the form of constructing the territory.

First, construction is one of the key economic sectors within the Spanish development model (11 percent of GDP vs. 5.8 percent in the EU), and one that has grown the most over the past decade. Its importance is related, among other factors, to a model of urban growth inherited from the nineteenth century and a deeply entrenched culture of home ownership, generated under the socioeconomic circumstances of the 1950s (lack of housing since the postwar period and promotion of ownership as a model of investment) and not redefined since then.

In addition, housing in Spain is inexorably linked with tourism development, which since the 1950s has been promoted as one of the key economic sectors. Spain, with its “Spain is different” slogan, became one of the major destinations of the so-called sun-and-beach tourism based more on secondary residences than on hotel stays. The decline of this kind of tourism in the 1980s in favor of more competitive destinations led to the launching of so-called plans of tourism excellence in the 1990s, based on diversifying the leisure on offer (marinas, theme parks, etc.). New types of tourist complexes, associated with these forms of entertainment, were since then planned.

The construction of both primary and secondary housing has experimented two booms in the last forty years which have notably influenced the form of the territory. The first boom in the early 1970s, was linked to late industrial development and largely to a real housing need. In 1973 a maximum of 500,000 houses were built, decreasing to 250,000 units per year over the next fifteen years. Spanish cities mainly grew through the ensanche (city extension) and the state-initiative public housing . Despite its many shortcomings, the ensanche as a compact city model proposed a dense, mixed-use urban form in continuity with existing historic centers. In turn, the large-scale tourist development of the coast (mainly the Mediterranean one) was based on the alignment of isolated buildings parallel to the beach.

The second boom, in the early 2000s, in a context of a postindustrial economy, was characterized by an increase in housing construction as investment rather than for real use. In 2006 a maximum of 660,000 private market housing were built, a quantity that dropped dramatically to only 80,000 in 2010. Cities expanded following a peripheral growth model based on large isolated developments with an almost exclusively residential role. They are connected to the major infrastructure axes and bear no relation to the context in which they are located. In most cases the location and housing offer is an exclusive decision of private investors, without forming part of a common environmental and land development strategy. The scale and type of coastal development have also changed. The new products of the tourism industry offer a concept or holiday style associated with a brand rather than a territory. They are megatouristic projects of a single developer, with housing, hotels, and leisure centers detached from the towns and landscapes where they are located. These complexes are no longer necessarily on the coastline, but in an area of influence of 15–20 km.

Secondly, the form of building the territory is also consequence of the excessive linking of the housing sector with a liberal real estate market (in Spain, 89 percent of houses belong to the free market). This generates two main problems in relation to the territory: excessive consumption of land and resources, and the trivialization of the landscape.

On the one hand, territory is the physical basis of a real estate market based on sprawl logic. The fragmented occupation of isolated areas far away from existing cities is a consequence of the real estate investment logic, in which profitability is based on the low cost of land. The problem is not just the amount of land consumed by housing, but the exponential increase in energy consumption, infrastructure, and commercial and recreational areas derived from this expansive model.

On the other hand, considering housing essentially as an exchange value as opposed to an object of use leads to a homogenization of the environment. In the global market context, Richard Sennett notes in relation to office buildings that “the neutrality of new buildings also results from their global currency as investment units.(…) Standardization of the environment results from the economy of impermanence, and standardization begets indifference.” In the housing market context , housing as a unit of investment tends to be as neutral as possible in formal and typological terms, and can thus be more easily exchanged in the market. The type of real estate that does not respond to a real need, that lacks a defined socioeconomic project, does not encourage a reflection on new housing or urban models.

In this sense, inherited typologies (block and detached houses), which, taken out of context, lose their logic, are used as referents to define a market product. The block is used as an urban reference. However, in the absence of major urban attributes (density, mixed uses, public spaces and facilities, economic activities, etc.), the block itself is not capable of generating a city. The detached house typology refers to an imaginary suburban life. In many cases, it is formalized as an addition of equal units in excessively urbanized and self-referential environments, which do not take advantage of the possible relationship with nature and the landscape due to their peripheral location.

Uniformity is not just aesthetic. As Francesc Muñoz explains, it also affects “the restriction of use patterns and possible behaviors in the space.” Furthermore, it is difficult for new settlements to become cultural or symbolic referents owing to little or no presence of public buildings and the lack of citizen participation in their definition.

In conclusion, this archipelago of scattered, isolated developments, uniform in terms of urban form, morphology, and uses, bereft of symbolic content, and de-territorialized, has given form to new speculative landscapes: homogeneous landscapes as a permanent effect of the economy of impermanence.

Appendix: Local Planning Instruments to Make It Happen

The Spanish housing boom cannot be understood (apart from the favorable global economic context and a remarkable reduction in interest rates that encouraged home ownership) without analyzing certain specific planning instruments.

On the one hand, in 1998 the government passed a new, markedly liberal Land Act. The main objectives thereof were to increase the land supply and streamline its management: “The present Law aims to facilitate the increase in land supply, meaning that all land which has not yet been incorporated into the urban process, in which there are no reasons for preservation, can be considered capable of being urbanized....It must also be remembered that the land market reform in the direction of greater liberalization which increases its offer is part of the necessary structural reform of the Spanish economy.”

To this end, a new actor was introduced, the developer agent (agente urbanizador), who is neither the owner of the land nor the administration. The creation of this figure was intended to end the retention of land by owners who refused to participate in urban development, to speed up the urbanization process, managed thereby by a single developer, and to place more and cheaper land on the market with the aim of increasing the housing supply. But in fact these objectives have not been attained. First, flexibility in management has given way to excesses of power which, linked to a lack of transparency, have not allowed alternatives to proposals from developer agents to be considered. Second, the desired improvement to housing access did not come to fruition, as the oversupply of a speculative offer has increased market prices greatly.

On the other hand, the enormous urban growth is the result of the addition of local logics in land management. City councils have had too much freedom to reclassify land (make it developable) and to approve urban growth in the absence of supramunicipal or regional planning guidelines. Reclassifications and subsequent building permits issued by municipalities have proved to be the principal source of municipal (and sometimes also personal) revenue, giving rise to numerous cases of urban corruption.

As a result of the liberalization of land management, the reclassification of urban land has been accelerated in a moment of construction euphoria in which no one wanted to be left behind. Rather than providing an opportunity to create competitiveness and synergies between different municipalities, municipal autonomy has instead been a tool for the uniformity of banal construction competing in the same market.

2. A Guide to Spanish Financial Bubble Typologies

As a way of showing the form of the financial bubble, a series of portraits of this mosaic of isolated developments, which generate homogeneous, banal, and self-referential landscapes, are proposed. Although the diversity of forms of the financial bubble is considerable, it is possible to identify certain typologies or ways of building the country, located in the areas with higher growth (Madrid and the neighboring provinces of Castile; and the Mediterranean coast from Valencia to Malaga). These are the new versions of the architecture of the sun and the new models of urban growth, which we could categorize as leisure investments and peripheral investments.

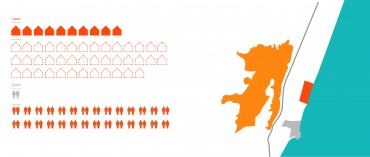

Leisure Investments

The real estate boom has encouraged the emergence of large tourist resorts of around 10,000 housing units. The analyzed case studies forecast a total of 70,000 dwellings in an area of 45 million square meters, of which only over 20 percent have been built so far.

Coast Filling

The process of filling the coast for tourism purposes, has led to the occupation of more than 20 percent of the first kilometer of the Mediterranean coast, reaching in some provinces, such as the extreme case of Malaga, 59.5 percent. New seafront developments employ the typology of blocks set perpendicular to the coast with a small seafront, increasing the number of apartments which, although not strictly located on the seafront, form part of blocks that are. The relationship with the sea and the beach is becoming less important and, indeed, the newest developments are completely disengaged from it, but still guarantee a wide range of leisure activities in a climate with more than 300 days of sunshine per year.

CASE STUDY I

MARINA D’OR. Ciudad de vacaciones & MARINA D’OR GOLF

Location………………………………Oropesa / Cabanes (Castellón)

Year……………………………………………..………………1998 / 2005

Developer…………………………………………..………… Marina d’Or

Ground surface………………………...100.000 m2 / 18.000.000 m2

Housing units…………………………………………....10.000 / 40.000

Housing units sold (2007)…………………………………. .. 5.000 / 0

Population expected…………………………………..40.000 / 120.000

Population municipality (2001)……...........................4.287 / 3.128

Population increase..……….....................................330% / 1400%

Countryside Golfscapes

Now that the seafront is practically full, emerges a new precoastal strip where the golf course replaces the sea as the claim. Many of the 416 golf courses in Spain are linked to housing developments and around 60 per cent of them are located in Andalucia and Murcia . They work as private enclosures with controlled access, creating a monofunctional and self-referential environment. Many of them are in areas with water shortages. In the summer, residential golf developments consume between 25 to 40 cubic meters of water per person per month, compared with 9 cubic meters for a compact city. This is due not so much to the irrigation of the courses, but to the type of urbanization: large, detached houses with gardens and pools.

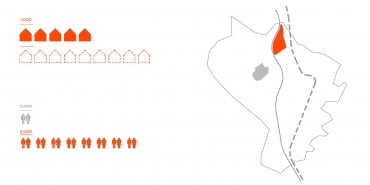

CASE STUDY II

LA TORRE & MAR MENOR I - II GOLF RESORTS

Location………………………………………Torre Pacheco (Murcia)

Year……………………………………………………………………2001

Developer…………………………………………………Polaris World

Ground surface………………………………………….5.940.000 m2

Housing units…………………………………………………..….9.406

Housing units built (2009)………………………………………4.906

Population expected…………………………………………….26.000

Population municipality (2001)……………………………....24.332

Population increase ..…………………………………………….200%

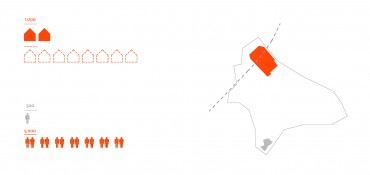

Paper Parks

The term paper park is defined as “a legally established protected area where experts believe current protection activities are insufficient to halt degradation.” Thousands of hectares of the protected natural areas in Murcia were left unprotected in 2001 by a law providing for only the conservation of those lands included within the European network Natura 2000. Marina de Cope is located along nearly seven kilometers of unspoiled coastline and is the largest resort planned for the Mediterranean coast. The late tourist development of this area was due to the fact of its being a protected natural area and to a lack of infrastructure. These impediments were removed with the lack of protection since 2001 and with the construction of a new highway and airport.

CASE STUDY III

MARINA DE COPE

Location…………………………………………………Aguilas (Murcia)

Year…………………………………………………………………….2005

Developer……………………………………………Landmark + EDSA

Ground surface…………………………………………21.180.210 m2

Housing units……………………………………………………....9.000

Population expected……………………………………………..25.000

Population municipality (2009)………………………………..34.533

Population increase .……………………………………………..172%

Peripheral Investments

The financial bubble has promoted macrodevelopments from 30,000 to 100,000 inhabitants. The case studies analyzed foresee a total of 73,000 dwellings on 18 million square meters in Madrid and its area of influence.

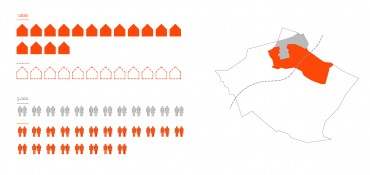

New Towns / case study IV-V

In the neighboring provinces to Madrid, uniform developments of more than 10,000 housing units built entirely from scratch by a single developer agent have been started. They are located within a radius of 50 km from the capital, in hitherto empty areas that were reclassified and revalued, connected to main infrastructure lines, and disconnected from the nearest cities or villages. When a city is not associated with the existence of population but rather with the market, and people are replaced by investors, cities are built, but there are not enough people living in them. Of the potential 40,000 inhabitants in Seseña, only 750 were registered in 2008, and in Valdeluz there were only slightly more than 400 registered inhabitants in 2009 of the 35,000 expected.

CASE STUDY IV

URBANIZACION FRANCISCO HERNANDO

Location……………………………………………….Seseña (Toledo)

Year…………………………………………………………..………2003

Developer……………..…..........................................ONDE 2000

Ground surface…………………………………………1.600.000 m2

Housing units……………………………………………………13.800

Population expected……………………………………………40.000

Population municipality (2000).………………………………4.244

Population increase ..…………………………………………1000%

CASE STUDY V

CIUDAD VALDELUZ

Location…………………………………………Yebes (Guadalajara)

Year……………………………………………………………………2001

Developer……………………………………………………Reyal Urbis

Ground surface…………………………………….……1.340.000 m2

Housing units………………………………………………………9.500

Population expected…………………………………………....35.000

Population municipality (2001)……………………………………168

Population increase ..…………………………………………20.000%

Urban Hyperexpansion / case study VI-VII

In recent years, Madrid has experienced a significant population increase of about one million inhabitants. During this period the city council has begun the construction of six urban action plans (UAP) and eight so-called new developments, to provide Madrid with nearly 200,000 new homes. The new ensanches of the twenty-first century extend the urban centers of the neighborhoods developed on the outskirts of Madrid in the 1950s. Different private investors are involved, which introduces greater diversity in housing and public spaces. While around 85 percent of UAP dwellings have been already occupied, none of the 130,000 homes planned in the new developments has yet been built. Madrid’s southeastern landscape is currently a “stand-by” landscape, defined by land works and the construction of new roads and infrastructure.

CASE STUDY VI

PAU ENSANCHE DE VALLECAS

Location………………………………………………Vallecas (Madrid)

Year…………………………………………………………………….1999

Developer…………………Madrid municipality + private investors

Ground surface……………………………………….….7.200.000 m2

Housing units……………………………………………….…….28.000

Population expected…………………………………………....100.000

Population district (2001)……………………………………….62.916

Population increase ..……………………………………………..260%

CASE STUDY VII

LOS BERROCALES

Location………………………………………….…...Vicálvaro (Madrid)

Year ………………….………………………….……………………..2005

Developer……………….…Madrid municipality + private investors

Ground surface…………………………………………...7.800.000 m2

Housing units………………………………………………………22.000

Population expected………………………………………………70.000

Population district (2009)………………………………………..68.716

Population increase ………………………………………………..201%

3. Speculation as Shrinkage Cause: New Models for a Postindustrial Society

Spain is currently confronted with two key issues: first, what to do with what has already been built; and second, what to do with the land that has been already been reclassified.

In coming years Spain will face a phenomenon that can be likened to shrinkage. This term defines the phenomenon of population and economic activity loss in certain cities leading to an abandonment of existing urban structures. Four factors are considered as a cause of decrease: “deindustrialization, suburbanization, post-socialist transformation, and fast aging”. We could also consider a fifth cause: speculation, related not to a loss of population or economic activity, but to the absence of both from the outset. Rather than shrinking cities, these are cities that did not have enough people in relation to the infrastructure which has been built. These new oversized, depopulated urban structures can have the same problems and opportunities as other types of shrinking cities.

Furthermore, in the service economy era, urban growth factors are now exclusively associated to location in relation to the proximity of a production or consumption center, as in the industrial age. As José Miguel Iribas explains, new aspects traditionally disengaged from the production system (for example, climate, urban and environmental quality, connectivity, and leisure and cultural offers) could define new models of growth in the postindustrial economy. In this sense, new models should be based on economic diversification, integrating tourism as a layer of a more complex system, and not as the only driving force, which simplifies the landscape and uses of a territory.

Spain has become more a laboratory for studying the effects of the market economy and speculation typologies than a benchmark of new typologies in the postindustrial era. Construction, at least in the near future, will still be an important economic sector, although it would be logical to reduce its importance in favor of other sectors with less territorial and ecological impact. In future growth should not be considered as the only development strategy and housing should be designed from the perspective of use rather than investment.

These interrupted times should be the occasion to revise approved development plans and to consider whether the future scenario should be different than just developing as much as possible. If the way in which the large amount of reclassified land is managed does not change, we could talk in terms of a future financial bubble, of a third construction boom (and crash), probably even greater than the previous one.

Spain will not be interrupted for a long period, but will have to find new ways of moving ahead. Perhaps then the former “Spain is different” will give way to a new “Spain builds differently.”

--

REFERENCES

1 Ministerio de Vivienda, www.mviv.es.

2 “Construcción y vivienda,” in Informe de Sostenibilidad en España 2009 (Madrid: Observatorio de la sostenibilidad en España, 2009), 161–72.

3 José Manuel Naredo, “Perspectivas de la vivienda,” in ICE Información Comercial Española no. 815 (2004).

4 María del Carmen Guisan and Eva Aguayo, “Second Homes in the Spanish Regions: Evolution in 2001–2007 and Impact on Tourism, GDP and Employment,” in Regional and Sectoral Economic Studies 10, no. 2 (2010).

5 Eugenio Burriel, “Los límites del planeamiento urbanístico municipal,” in Doc. Análisis Geográfica no. 54 (Universidad de Valencia, 2009), 34–38.

6 Carine Fournier, “Le complexe touristique de Marina d’Or a Oropesa de Mar,” in Téoros, revue de recherche en tourisme 27, no. 2 (2008): 18–22.

7 Observatorio de la sostenibilidad en España (OSE), Cambios de ocupación del suelo en España: Implicaciones para la sostenibilidad (Madrid: Mundi Prensa, 2006), 439–47.

8 Richard Sennett, “Capitalism and the City,” lecture given at the symposium “cITy: Daten zur Stadt unter den Bedingungen der Informationstechnologie,” ZKM Karlsruhe, November 11, 2000.

9 Francesc Muñoz, Urbanalización (Barcelona: Gustavo Gili, 2008), 200–203.

10 “Ley 6/1998, de 13 de abril, sobre régimen del suelo y valoraciones,” in Boletín Oficial del Estado no. 89 (1998): 12296.

11 Síndic de Greuges de la Comunitat Valenciana, “La actividad urbanística en la Comunidad Valenciana” (2004), 16–18, 24–26.

12 José Ramón Navarro and Armando Ortuño, “Estudio sobre el impacto territorial de los campos de golf y las operaciones asociadas en la Comunidad Valenciana y Murcia,” Universidad de Alicante (forthcoming).

13 “Paper Parks: Why They Happen, and What Can Be Done to Change Them,” MPA News 2, no. 11 (June 2001): 1.

14vGreenpeace, “Parques de papel,” in Destrucción a toda costa 2009, situación del litoral español y sus espacios protegidos (2009), 19–21.

15 Philipp Oswalt and Tim Rieniets, Atlas of Shrinking Cities (Ostfildern: Hatje Cantz, 2006), 12–14.

16 José Manuel Iribas, El efecto Albacete (Barcelona: Actar, IaaC, 2007), 87–90

DATA SOURCES CASES STUDY

INE Instituto Nacional de estadística: www.ine.es

I.1. Marina d’Or group: www.marinador.com / www.marinadorgolf.es

I.2. Carine Fournier, “Le complexe touristique de Marina d’Or a Oropesa de Mar”, in Teoros, revue de recherche et de tourisme, Université du Québec à Montréal 27-2 | 2008.

II.1. Polaris World: www.polaris-world-resorts.com

II.2. “Los proyectos de Polaris World, uno a uno”, in La verdad, 06/02/2006.

III.1 Municipality Las Aguilas: www.ayuntamientodeaguilas.org

III.2 José Antonio García Charton, “Marina de Cope”, in La verdad, 12/05/2008.

IV.1 ONDE 2000: www.onde2000.com

IV.2 Natalia Junquera, “Sesena, el fiasco inmobiliario”, in El País ,07/04/2008.

V.1 Reyal Urbis: www.ciudadvaldeluz.com

V.2 Vecinos Valdeluz: http://vecinosvaldeluz.wordpress.com

VI-VII. Municipality of Madrid: http://www.madrid.es

Download article as PDF